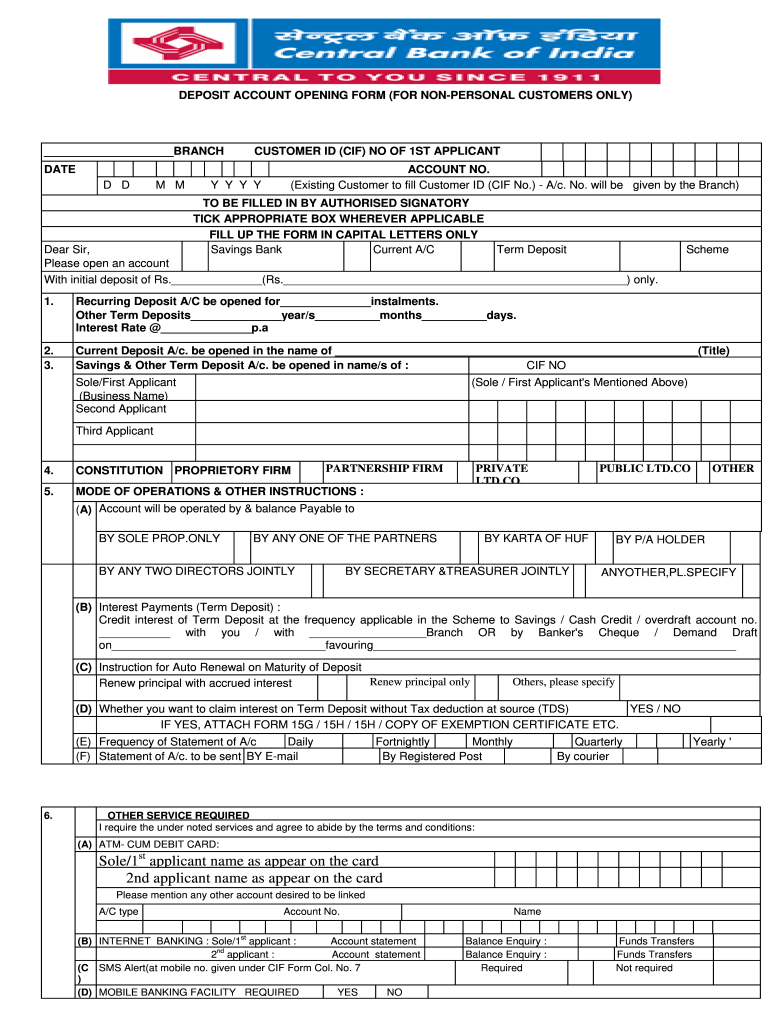

Central Bank of India Deposit Account Opening free printable template

Show details

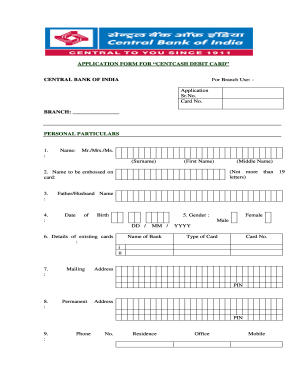

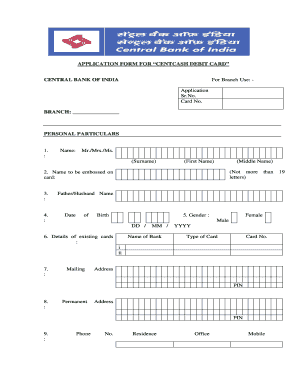

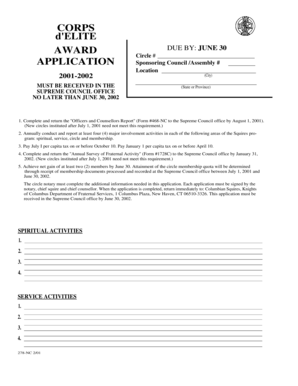

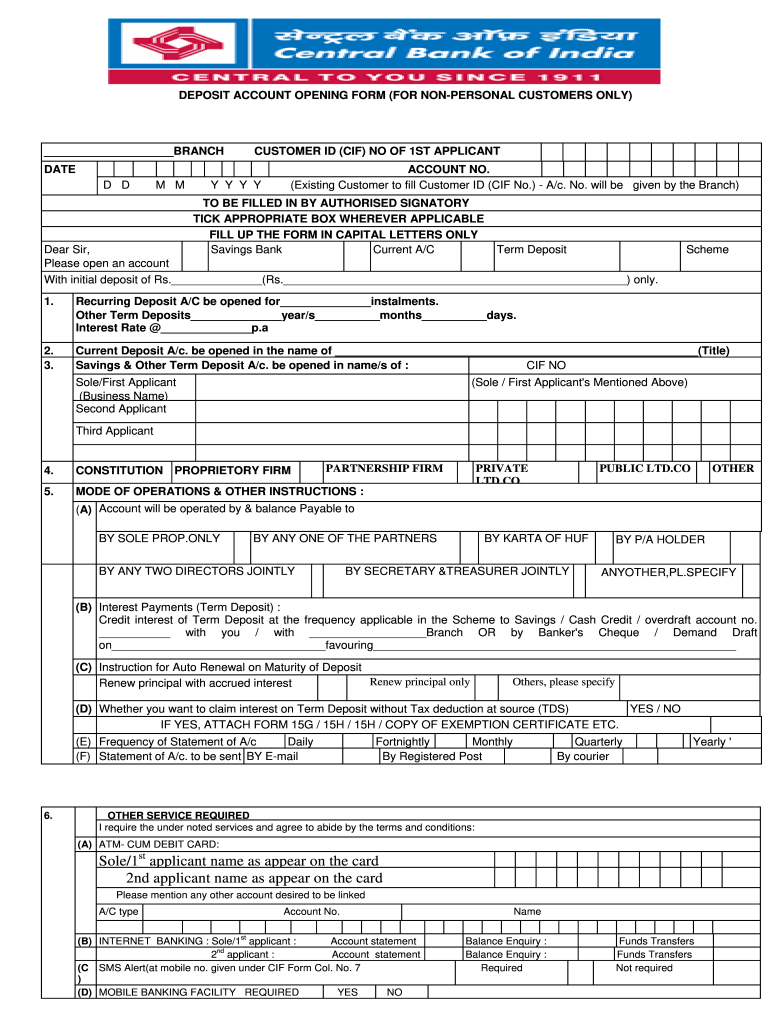

Existing Customer to fill Customer ID CIF No. - A/c. No. will be given by the Branch TO BE FILLED IN BY AUTHORISED SIGNATORY TICK APPROPRIATE BOX WHEREVER APPLICABLE FILL UP THE FORM IN CAPITAL LETTERS ONLY Savings Bank Current A/C Dear Sir Term Deposit Please open an account With initial deposit of Rs. DEPOSIT ACCOUNT OPENING FORM FOR NON-PERSONAL CUSTOMERS ONLY BRANCH CUSTOMER ID CIF NO OF 1ST APPLICANT DATE D D M M Y Y Y Y ACCOUNT NO. Rs. only. Scheme Recurring Deposit A/C be opened...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign how to fill out central bank of india deposit account accuracy and completeness before submission form

Edit your how to fill out central bank of india deposit account by central bank of india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central bank of india form fill up sample pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central bank of india account opening form filling sample pdf online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit central form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central bank of india account opening form

How to fill out Central Bank of India Deposit Account Opening Form

01

Obtain the Central Bank of India Deposit Account Opening Form from the bank or download it from the official website.

02

Fill in your personal details in the designated fields including your name, address, contact number, and email.

03

Provide necessary identification information, such as your PAN card number or Aadhar number.

04

Specify the type of deposit account you wish to open, such as savings or current account.

05

Fill in the details regarding the initial deposit amount.

06

Include any nominee details if applicable, along with their relationship to you.

07

Review the form for accuracy and completeness before submission.

08

Sign the application form at the designated location.

09

Submit the completed form along with the required documents to the bank branch.

Who needs Central Bank of India Deposit Account Opening Form?

01

Individuals looking to open a new deposit account with the Central Bank of India.

02

Businesses or organizations wanting to establish a corporate deposit account.

03

Any customer who wishes to avail banking services offered by Central Bank of India.

Fill

cbi form

: Try Risk Free

People Also Ask about specify the type of deposit as savings or current account text fill in the details regarding the initial deposit amount text include any nominee details if

How can I open a new account in Central Bank of India?

Account can be opened by visiting any of our branches in India and submitting account opening form and relevant documents. You can also send scanned account opening form and required documents to any of our branches by Email. Copies of any of Utility bills viz.

How much does it cost to open a new account in Central Bank of India?

An account can be opened with initial deposit of Rs. 50/-. Minimum balance of Rs. 50/-

How much money do I need to open a bank account at Central Bank?

You want a checking account with perks - security, savings, and much more! $50 Minimum to Open. $8.95 Monthly Fee. Free Transactions at Central Bank ATMs. ATM Refunds outside of Central Bank ATMs** Free Checks & Money Orders. Credit File Monitoring1 Access to Credit Score2 & Reports2 Bill Pay FREE with eStatements.

What is account opening process?

Account Opening Process means the process by which the Client submits to the Company an Account Opening Application Form together with all information and documentation required for performing the Client due diligence and identification in ance with the Applicable Regulations.

What is the minimum balance required in Central Bank of India?

Eligibility Criteria For rural and semi-urban areas, the quarterly Central Bank savings account minimum balance is Rs 50,000; for metropolitan and urban areas, the quarterly Central Bank savings account minimum balance is Rs 1,00,000, respectively.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in filling sample pdf how to fill out central bank of india deposit account?

With pdfFiller, it's easy to make changes. Open your central bank of india account opening form pdf in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit how to fill out central bank new your name address contact number and email in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your central bank of india form fill up, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit bank form fill up on an iOS device?

You certainly can. You can quickly edit, distribute, and sign central bank of india application form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Central Bank of India Deposit Account Opening Form?

The Central Bank of India Deposit Account Opening Form is an official document required to open a deposit account with the Central Bank of India.

Who is required to file Central Bank of India Deposit Account Opening Form?

Individuals or entities wishing to open a deposit account with the Central Bank of India must file the Central Bank of India Deposit Account Opening Form.

How to fill out Central Bank of India Deposit Account Opening Form?

To fill out the form, provide personal identification details, contact information, and specify the type of deposit account desired, along with any required identification and address proofs.

What is the purpose of Central Bank of India Deposit Account Opening Form?

The purpose of the form is to collect necessary information from the account holder to facilitate the opening of a deposit account and to comply with regulatory requirements.

What information must be reported on Central Bank of India Deposit Account Opening Form?

The form requires reporting of personal details such as name, address, date of birth, identification proof, contact number, and the type of account to be opened.

Fill out your Central Bank of India Deposit Account Opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Bank Form Fill Up is not the form you're looking for?Search for another form here.

Keywords relevant to central bank of india form kaise bhare

Related to central bank account opening form fill up

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.